17.

That’s the number of bills and payments I need to track each month.

To keep my head from exploding, I use a budget calendar to handle them like clockwork.

In this post, you will find:

- A step-by-step guide to using a budget calendar

- Free budget calendar templates, worksheets, printables

- A digital app so you can take your budget calendar on the go

Disclosure: Opinions expressed are our own. If you buy something through any of our affiliate links on this page, we may earn a commission at no extra cost to you. Thanks for supporting our site.

Erin Condren budget starter pack

Physical planners your thing? If pretty colors and a beautiful design will keep you pumped about your budget, then this budget planner package will get you oohing and aahing all the way to the bank.

This pack includes:

- Petite Planner, so you can plan all 12 months of the year in style

- Goal tracking

- Weekly and monthly spending trackers

- Snap-in budget dashboard to track bills and savings

- Decorative stickers and paper tape

What is a budget calendar

A budget calendar tracks when large amounts of money come into and go out from your bank account each month.

It’s like a roadmap that helps you stay on top of your payments throughout the month to make sure that you don’t miss a bill (and get charged extra fees or interest for it).

It's not meant to detail every single expense you incur, but more to give you an overall sense of how your finances are affected by larger chunks of money.

Having a clear sense of what payments are coming up helps you better prepare to have funds available by the time your major bills are due, rather than scrambling to pull together money at the last minute (which would most likely result in a big, fat money fail).

While surprises are usually fan, not so much when it comes to your bills and expenses.

How to use a budget calendar

If you plan to use your own budget calendar, there are three main budget categories of items you should log onto it.

Income

- Regular income such as paychecks

- Irregular income, such as from a side hustle, if you know the date you are going to be paid out

Recurring bills

This includes payments with set dates each month, such as for:

- Mortgage/rent

- Utilities

- Water

- Electricity

- Phone

- Cable

- Car payment

- Credit cards

- Student loans

- Monthly bills

There are other recurring bills that come every few months that you can add to your calendar as well, like:

- Insurance payments

- Annual or monthly subscriptions

- Tax payments

- Donations

TIP: Prefer to work your budgets by month instead of year? To make sure you don’t forget about these once-in-a-while bills, make a list of them on a post-it so you can transfer the sticky over easily each month.

If you have a general routine for common expenses, such as buying gas or groceries once every week, you can add them to your calendar as well. List these with the estimated spend, since you won’t know the exact amount.

DO THIS: Seriously, DO THIS: Include savings as a part of your recurring bills. Whether to build up an emergency fund or invest in your IRA, mark this on the earlier part of your calendar so you have time to actually do it.

Non-recurring expenses

You aren’t limited to only recording your recurring expenses. If you have something coming up that you know you’ll need to spend some money on, you could choose to put it on your calendar also.

Examples include:

- Children-related costs, like snacks for the next soccer game

- Gifts

- Clothing

- Entertainment

- Special occasions

Free budget calendars

Personal finance is all about picking what works best for you.

Just as different people prefer different budgeting styles, there are all kinds of budget calendars too, some that may work better for you than others.

If you’re a pen and paper kind of person, use a traditional calendar printable. Or, maybe a digital calendar would appeal to you more.

If you’re more of a techy, a budgeting app with a built-in calendar would be right up your alley.

No matter how you want to manage your money, the budget calendar round up below will have an option for you.

Printable

If you want something simple yet vibrant, check out this bill payment budget calendar. (via Clean and Scentsible)

Annual budget

For something that is broken down by month but shows you the entire year on a single page, try this budget plan. (via Freebie Finding Mom)

Excel spreadsheet

This Excel budget spreadsheet that lets you enter your bills in a calendar style view and then auto-magically totals your monthly spend. (via Vertex 42)

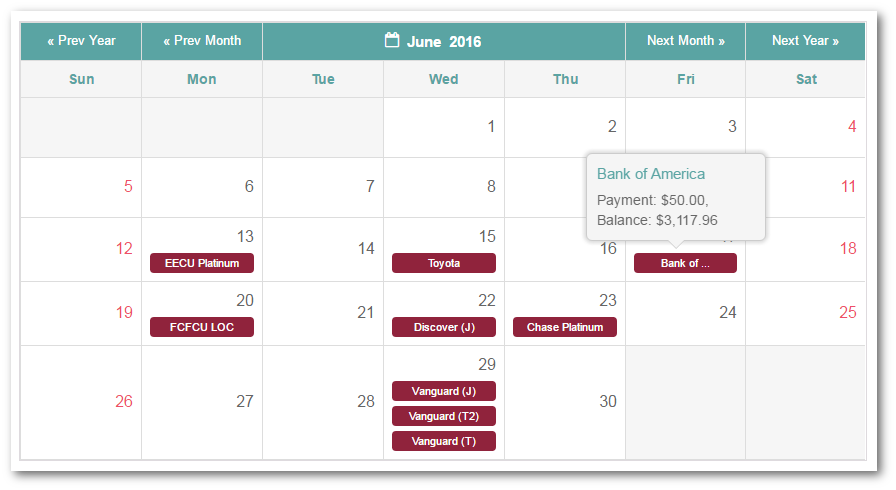

Budget calendar app

If you prefer to manage your money with modern technology, getting a premium membership with the Undebt.it debt management tool* is the way to go.

- Debt payoff calculator, table, chart

- Export and sort data in Excel

- Bill management

- Text message bill reminders

- Debt payoff snapshot stories

- Calendar view of payments due

Sign up for a 30-day free trial* to see if it’s right for you.

It’s 100% risk-free, since no payment info is required and your account will simply revert back to the free version once the trial is over.

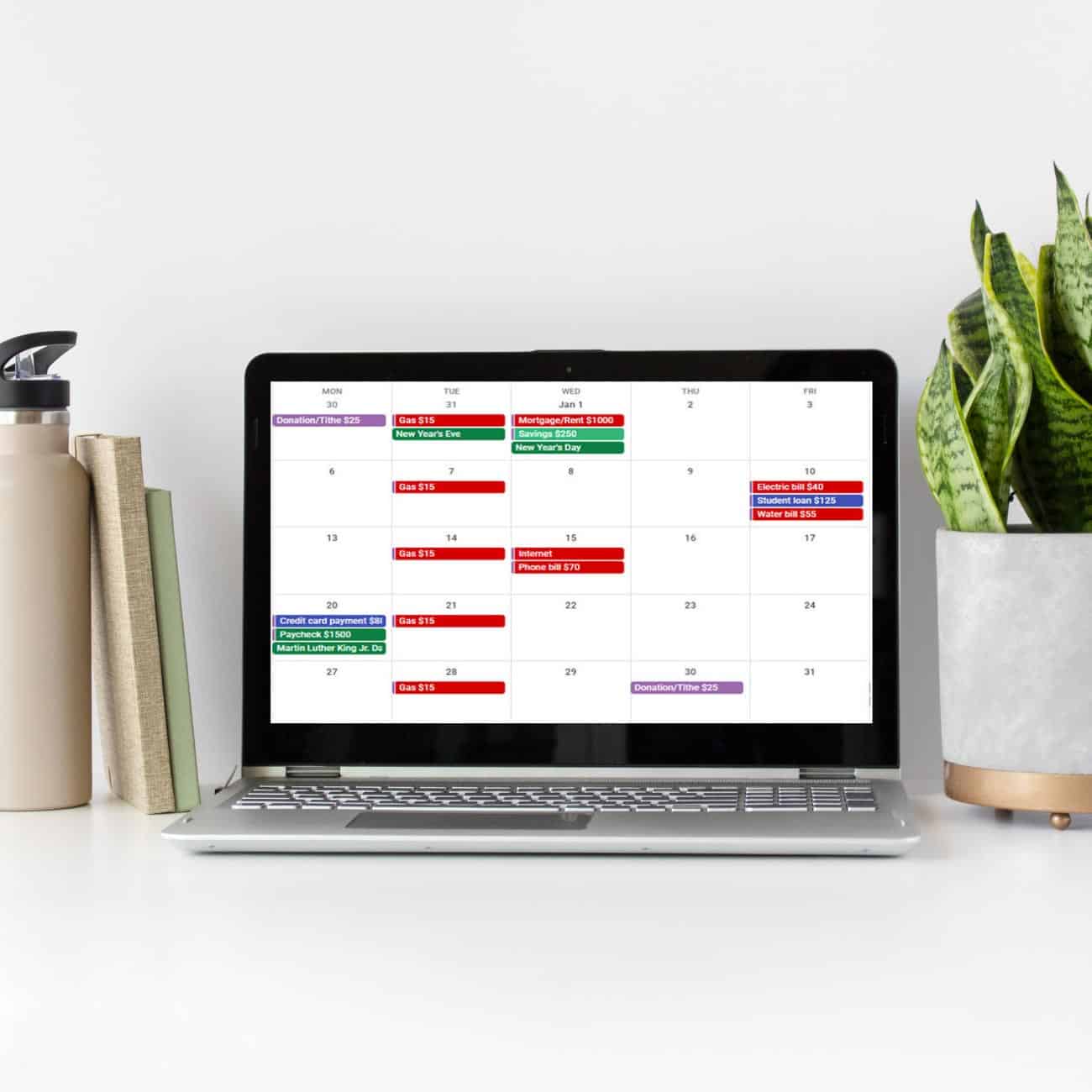

For Google calendar

If you’d like to track your bills using Google Calendar, grab our free template by clicking on the button below to automatically download to your device.

You can import to your Google account by following the instructions right under the download button.

ll you have to do is change the dates and amounts from our sample entries to whatever your payment dates and amounts are.

How to import our download to your Google calendar:

- Download the .zip folder and extract the .ical file

- Open Google Calendar

- At the top right, click the gear icon, then Settings

- At the left, click Import & Export

- Click Select File from Your Computer and select the ical file

- Choose which calendar to add the imported events to (you can create a new calendar just to keep these events, or add them to your existing calendar)

- Click Import

Grab This Freebie:

[Personal use only. To help us continue to offer this free resource to others, please share this post (not the direct file) before clicking to the freebie. Thank you!]

Share This: Save Pin | FB Share

Get Free Printable: Get the File

Conclusion

A budget calendar is a simple tool that can help you get your finances organized in no time (get it?).

Use any of these free budget printables, budgeting Excel spreadsheets, and digital budgeting apps to make tracking your bills a breeze.

Continue Reading: Save & Make Money posts →

Leave a Reply