Totally free printable Christmas activities, games, and worksheets for all ages.

From educational engagement for toddlers in preschool to Christmas party game ideas for adults, you're bound to find something fun for every one of your family, friends, students, coworkers, or anyone in a group!

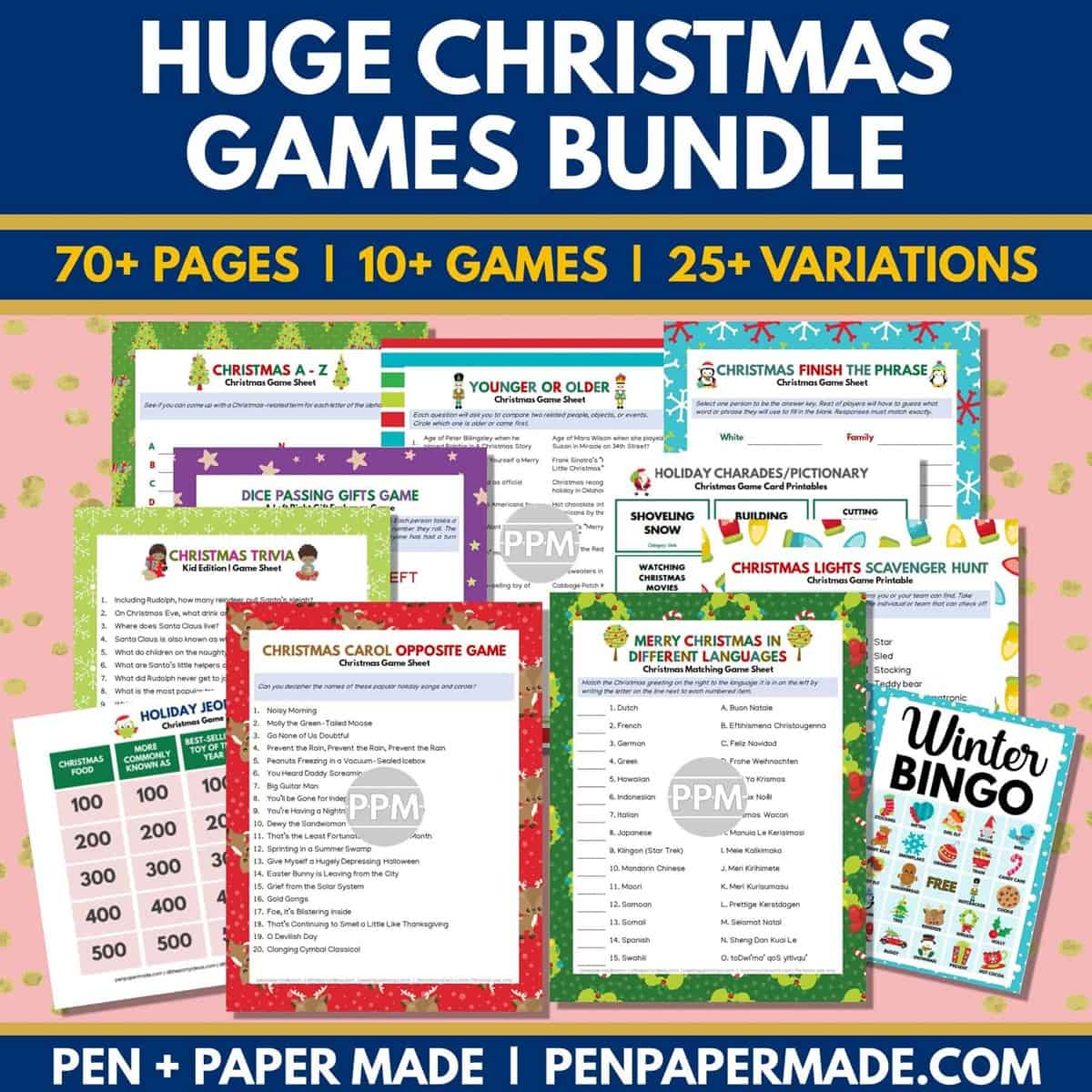

Christmas Games Bundle on Sale Now!

Snag our mega pack of our most popular Christmas game printables bundle for half off!

You get: 100+ Christmas bingo cards, 150+ Christmas charades and pictionary cards, Christmas left right gift exchange games, Christmas trivia, Christmas jeopardy, and more fun games!

Christmas Printable Activities

Christmas Coloring Pages

- Free Santa Coloring Pages, Sheets

- Free Reindeer Coloring Page, Sheets

- Free Christmas Tree Coloring Pages, Sheets

- Free Elf on the Shelf Coloring Pages, Sheets

- Free Elf Coloring Pages, Sheets

- Free Merry Christmas Coloring Pages, Sheets

- Free Christmas Dinosaur Coloring Pages, Sheets

- Free Christmas Dog & Puppy Coloring Pages, Sheets

- Free Christmas Cat Coloring Pages, Sheets

- Free Christmas Gnome Coloring Pages, Sheets

- Free Gingerbread House Coloring Pages, Sheets

- Free Disney Christmas Coloring Pages, Sheets

SEE ALL OF OUR Christmas coloring pages→

Leave a Reply